MARKETS

Social Real Estate and Other Core Markets

IMMAC was formed in Germany in 1997 and has since evolved into the country’s leading investment company for social real estate. In conjunction with the formation of IMMAC Holding AG in 2000, the group of companies was restructured and has successively grown over the past years.

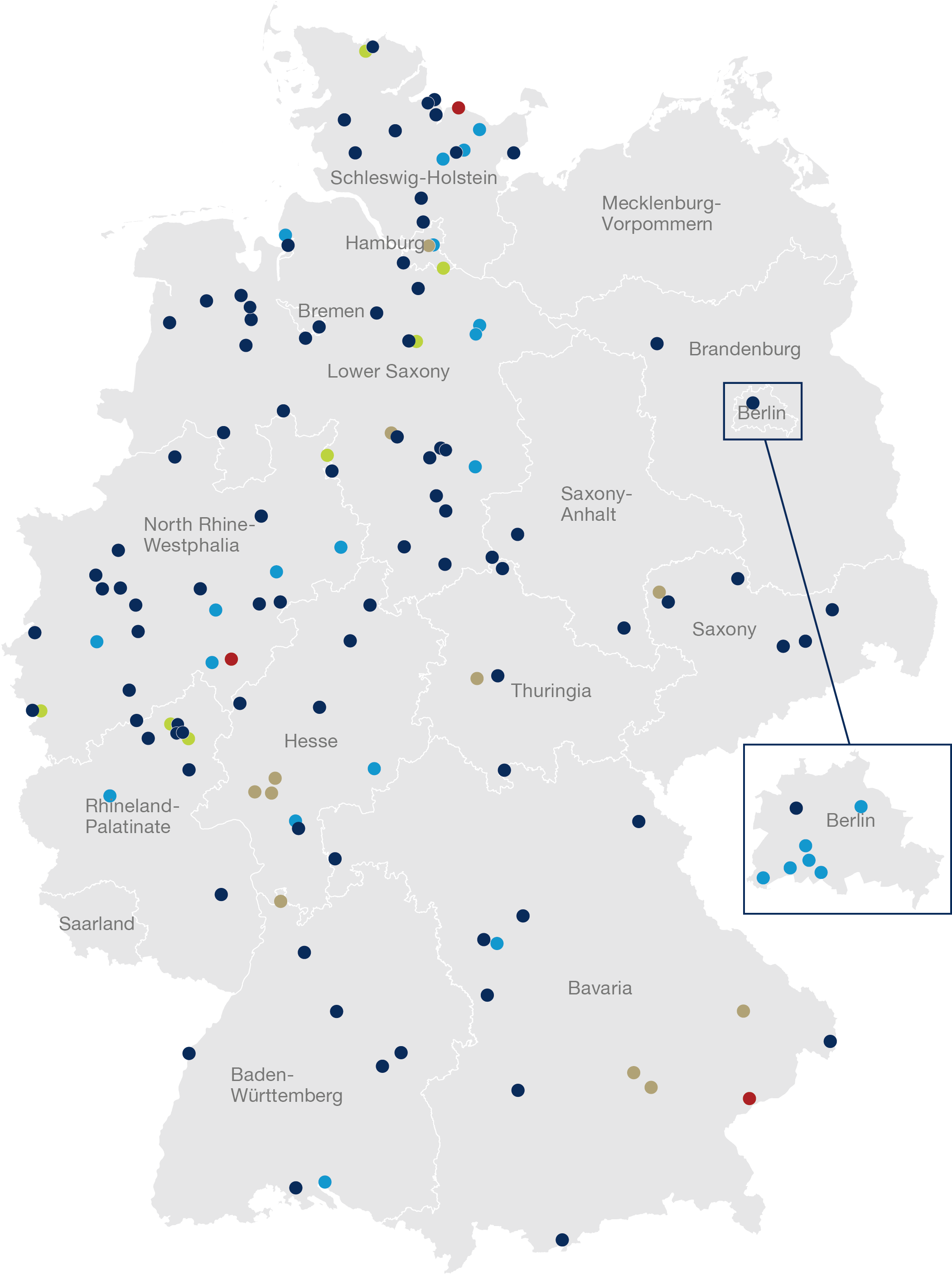

IMMAC in Germany

Today, IMMAC has 114 in-patient care facilities with more than 10,260 nursing care places and 767 annexed extra care apartments under management. Germany is therefore one of the core markets of IMMAC.

In addition to the clear-cut focus on in-patient nursing homes, 289 serviced-living units are either in planning or have already been completed by IMMAC’s housing construction arm, IMMAC Wohnbau.

The portfolio also includes three rehabilitation clinics with a combined total of 724 care spots. The portfolio is spread across Germany and involves 28 different operators.

114

Nursing homes

10,261

beds

767

assisted-living units

3

rehabilitation clinics

724

units

7

assets

289

assisted living units (existing + developments)

8

hotels

1,346

rooms

114

properties

28

operators

24

properties

IMMAC in Austria

In 2008, IMMAC took its first step to expand into other European countries.

The Austrian subsidiary IMMAC GmbH (Austria) was set up in Graz, the state capital of Styria, and has been implementing the experiences of the IMMAC Group in Austria, too.

Within the short period of six years, IMMAC Austria became Austria’s leading investor in healthcare real estate.

During these years, IMMAC acquired 23 in-patient care facilities with more than 2,086 nursing care places and 122 annexed extra care apartments.

Past acquisitions also include a rehabilitation clinic of 332 spots. The overall portfolio is spread across Austria and involves 11 different operators.

23

nursing homes

2,086

beds

122

assisted-living units

1

rehabilitation clinics

332

units

29

properties

11

operators

2

property

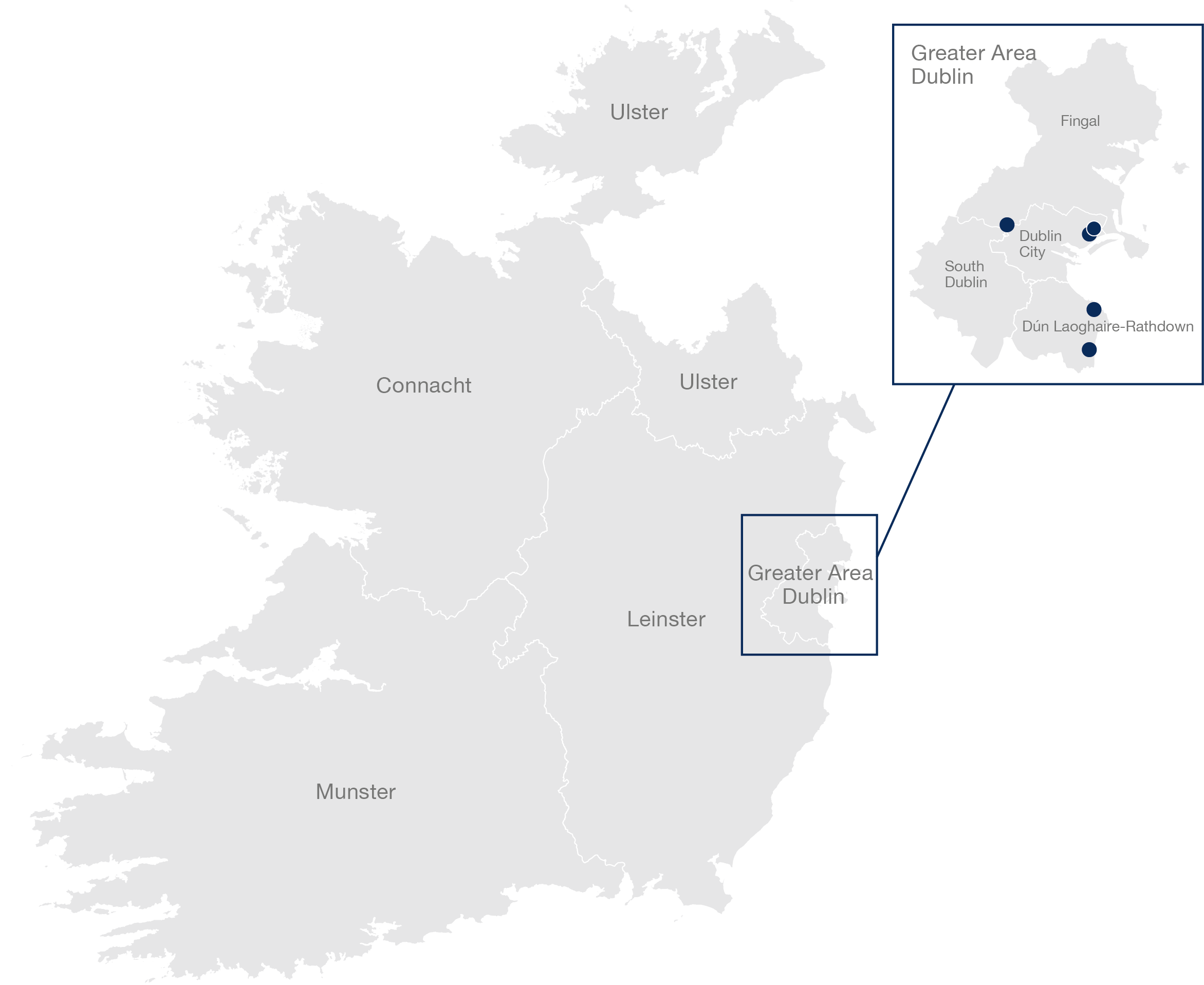

IMMAC in Ireland

In 2017, IMMAC made its entry into another European market. IMMAC Capital (Ireland) Limited was established in the Irish capital of Dublin and it successfully closed its first transaction in December 2017. It added 5 well-established care homes in Dublin plus the associated operator group to the international portfolio of IMMAC. In conjunction with the acquisition, the foundation stone was laid for a clear-cut trajectory to expand into another fast-growing nursing care market..

6

nursing homes

372

beds

6

properties

1

operator

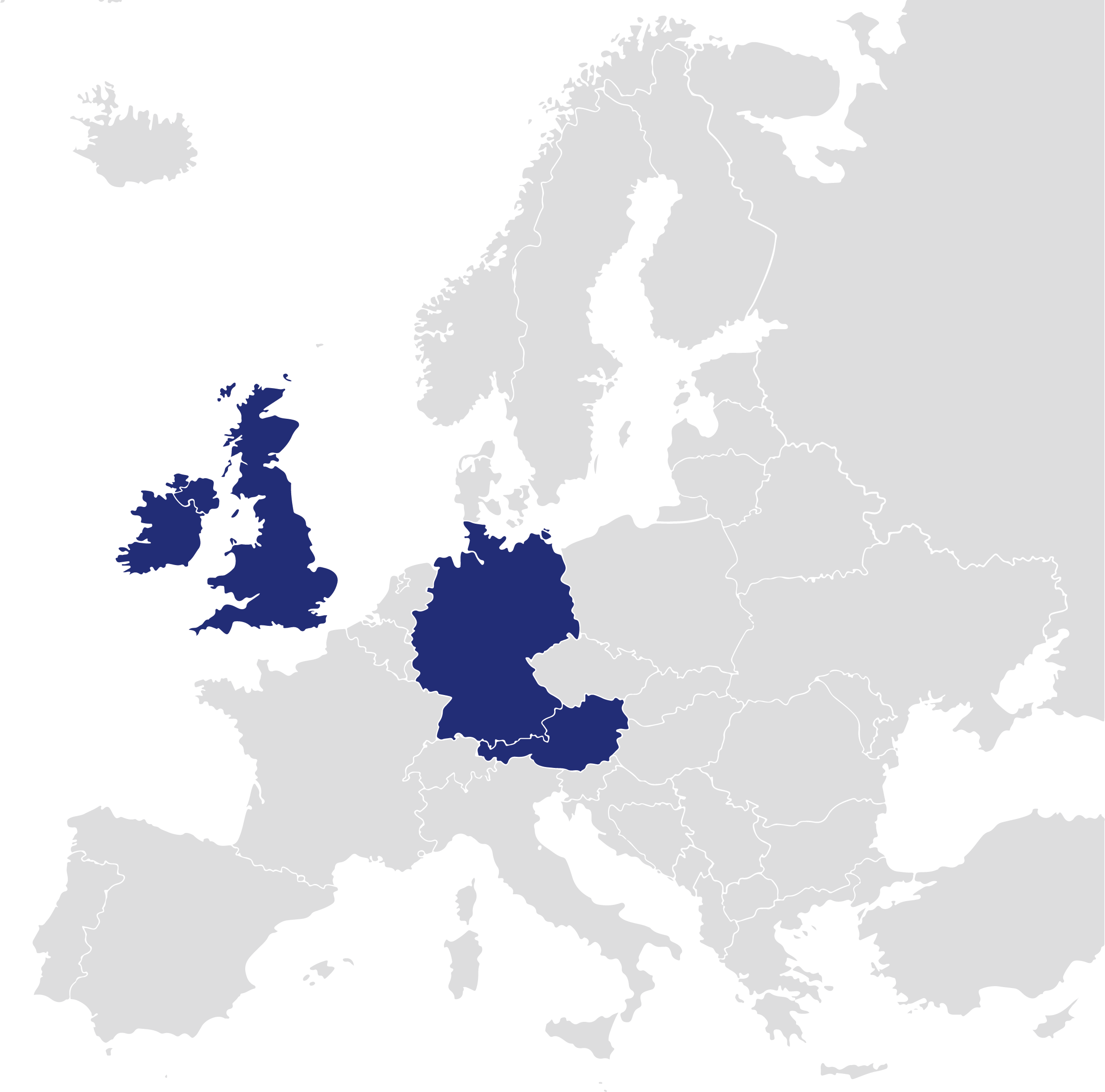

IMMAC outside Germany

The real estate market in the healthcare sector is relatively small. To keep growing and to meet the demand generated by the various market players, IMMAC is expanding outside Germany.

In doing so, IMMAC adheres to the same investment premises and quality standards it applies on its domestic market in Germany. In addition to its registered office and administrative seat in Hamburg, IMMAC already operates national branch offices in Graz (Austria), London (United Kingdom) and Dublin (Ireland). Other countries are under review for future expansions.

IMMAC’s activities outside Germany are subject to the condition that the socio-economic parameters of a given country are stable and predictable. Factors like the demand for nursing care spots, the demographic trend, and the refinancing options for healthcare assets are as crucial in this context as the country-specific quality of the real estate.

In each of its destination countries, IMMAC sets up a dedicated management team that is thoroughly familiar with the socio-economic specifics on location while meeting the high quality standards of IMMAC. Only if a given market meets all qualitative requirements will IMMAC commit itself in that foreign market.