IMMAC

High-Value real estate as concept for success

IMMAC is one of Europe’s leading companies for real estate investments in the healthcare sector. In the years since its formation in 1997, IMMAC group invested more than 2 billion euro in over 170 social real estate assets. The properties were either built or acquired for investment funds with long-term horizon.

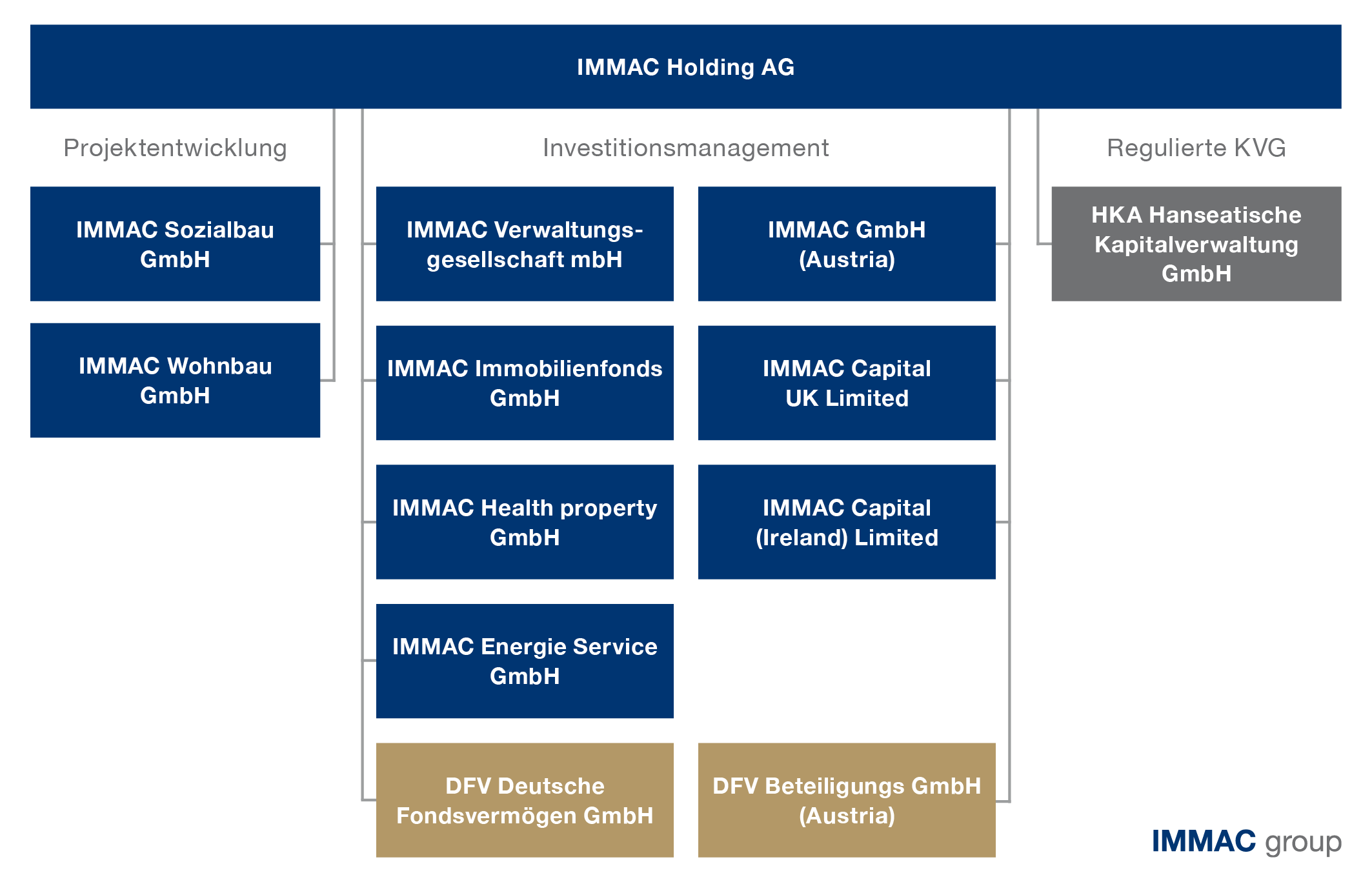

The focus on high-value real estate has proven worthwhile. It has served as basis for creating a mid-market, family-run non-bank group of companies under the umbrella of IMMAC Holding AG.

Facts and figures

- More than 170 healthcare properties, including in-patient care facilities, clinics and assisted living homes.

- Around 80 employees in the group of companies

- Annual investment volume of approx. 200 to 250 million euros

- IMMAC serves operators in the context of

- setting up and expanding operations,

- implementing sale & lease-back solutions,

- property developments and construction projects,

- selling entities and properties, e.g. in the succession planning context.

- IMMAC has its own two development companies, one specialising in the construction of care centres and clinics while the other specialises in retirement homes.

- IMMAC pursues a conservative strategy with a very long-term horizon.

IMMAC positions itself as peer-to-peer partner of healthcare property operators. - The main shareholders of the IMMAC group are Hannoversche Volksbank with 80% and the bank's own holding company GEORGE Holding GmbH, in which the Volksbank in Schaumburg and Nienburg also has a stake. Profunda Vermögen GmbH, an investment company owned by IMMAC founder Marcus H. Schiermann, is a minority shareholder with 20%.

One of IMMAC Group’s member companies is DFV Deutsche Fondsvermögen GmbH. With its international network, it focuses on hotel investments, special-purpose and operator real estate as well as infrastructure investments.

IMMAC group